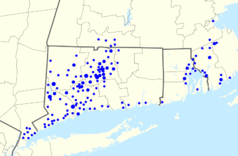

Webster Bank is an American commercial bank based in Stamford, Connecticut. It has 177 branches and 316 ATMs located in Connecticut; Massachusetts; Rhode Island; New Jersey; Westchester, Orange, Ulster, and Rockland counties in New York as well as New York City.[2]

Headquarters in Stamford, Connecticut | |

| Company type | Public company |

|---|---|

| Industry | Finance |

| Founded | 1935 in Waterbury, Connecticut |

| Headquarters | Stamford, Connecticut, U.S. |

Key people | John R. Ciulla, President and CEO James C. Smith, Chairman |

| Products | Banking |

| Revenue | US$1.20 billion (2019)[1] |

Number of employees | Approximately 3,400 |

| Website | websterbank |

History

editWebster was founded in 1935 by Harold Webster Smith as the First Federal Savings of Waterbury in Connecticut. Only 24 years old, Smith borrowed from family and friends to found the lending institution providing home loans to Connecticut citizens. He served as CEO until 1987 and as chairman of the board until 1995 when First Federal was renamed Webster Bank in his honor.[3]

Timeline

editAmong milestones in Webster's history:

- 1935: Harold Webster Smith founded a savings and loan, First Federal Savings of Waterbury.

- 1938: First Federal's assets grew to more than $1 million.

- 1986: First Federal converted to stock ownership and formed a holding company.

- 1987: James C. Smith became the company's second chief executive officer, succeeding his father, Harold Webster Smith, who continued as chairman.

- 1995: Harold Webster Smith retired as chairman and was succeeded by James C. Smith.

- 1997: Webster Trust Company, N.A. and Investment Services were added to the bank's offerings.

- 1998: Webster acquired Eagle Bank of Bristol, pushing its statewide branch total over 100.

- 1998: Webster became the first bank in Connecticut to purchase an insurance agency (Damman Insurance).

- 2002: Webster became listed on the New York Stock Exchange under the ticker symbol “WBS”.

- 2003: Webster announced a definitive agreement to acquire FIRSTFED AMERICA BANCORP, INC., the holding company for First Federal Savings Bank of America. The deal, which closed in May 2004, marked Webster's first retail expansion beyond Connecticut's borders and into the southeastern Massachusetts and Rhode Island markets.

- 2004: Webster announced that the Office of the Comptroller of the Currency (OCC) had accepted the company's application to be a chartered commercial bank.

- 2005: Webster acquired HSA Bank and becomes the leading bank administrator and trustee of health savings accounts in the nation.

- 2006: Webster acquired NewMil Bank.

- 2016: Webster acquired 17 Citibank branches in the Boston area and added additional ATMs to support the network.

- 2022: Webster acquired Sterling National Bank and moved its headquarters from Waterbury to Stamford.[4][5] The Sterling acquisition was for $10 billion.[6] In June 2022, Webster had approximately $25.9 billion in deposits in Connecticut.[6]

- 2023: Webster acquired Ametros Financial, a medical insurance settlement fund manager, for $350 million.[7]

Company

editWebster Financial Corporation is the holding company for Webster Bank, N.A. and Webster Insurance. Webster Bank owns the asset-based lending firm Webster Business Credit Corporation, the insurance premium finance company Budget Installment Corporation, Webster Capital Finance, and provides health savings account trustee and administrative services through HSA Bank of Sheboygan, Wisconsin, a division of Webster Bank.

In 2015, Webster Bank had over $24 billion in assets[8] and a market capitalization of over $3 billion. Its network included over 177 branches and 316 ATMs located in Connecticut; Massachusetts; Rhode Island; and Westchester County, New York.

After the $5 billion USD 2022 merger with Sterling, assets rose to $65 billion, with 202 branches, 380 ATMs, and a larger presence throughout the metropolitan New York city area, including New Jersey.[9] In 2024, it was the largest bank headquartered in Connecticut based on deposits, which in-state totaled $33 billion. John Ciulla was chairman and CEO.[10]

See also

editReferences

edit- ^ "Webster Financial Corporation 2017 Annual Report". Retrieved September 19, 2019.

- ^ "Banking Centers and ATMs". Jay Webster Financial Corporation. Retrieved May 14, 2024.

- ^ "Who We Are". Webster Financial Corporation. Retrieved January 30, 2014.

- ^ "WEBSTER, STERLING COMPLETE MERGER | Webster Financial Corporation". webster.gcs-web.com. Retrieved 2022-02-01.

- ^ Kavaler, Bernard. "Webster Bank Completes Merger, Moves Headquarters from Waterbury to Stamford". Connecticut by the Numbers. Retrieved 2022-02-01.

- ^ a b Schott, Paul (April 22, 2023), Stamford-based Webster Bank's deposits grow amid industry's 'unusual activity', CT Insider, retrieved November 16, 2024

{{citation}}: CS1 maint: year (link) - ^ "Webster Signs Definitive Agreement to Acquire Ametros". Yahoo Finance. 2023-12-14. Retrieved 2023-12-15.

- ^ "Webster Bank, National Association". Ibanknet. Retrieved July 7, 2015.

- ^ Gosselin, Kenneth R. (2022-02-01). "Webster Bank completes deal for New York lender, adding branch banking options for customers". Hartford Courant. Retrieved 2022-08-15.

- ^ Schott, Paul (July 22, 2024), Connecticut's largest bank experienced 'accessibility issues' in global tech outage, CT Insider, retrieved November 16, 2024

{{citation}}: CS1 maint: year (link)