Wikipedia:Today's featured article/September 16, 2022

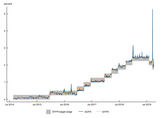

In September 2019, there was a sudden and unexpected spike in interest rates on overnight repurchase agreements (or "repos") – short-term loans between financial institutions. The interest rate on overnight repos in the United States increased from 2.43 percent on September 16 to 5.25 percent (graph shown). During the trading day, interest rates reached 10 percent. The Federal Reserve Bank of New York injected $75 billion into the repo market on September 17 and every morning for the rest of the week. On September 19, the Federal Reserve lowered the interest paid on bank reserves. These actions calmed the markets and, by September 20, rates had returned to a stable level. The Federal Reserve Bank of New York continued to regularly provide liquidity to the repo market until June 2020. Economists identified the main cause of the spike as a temporary shortage of cash available in the financial system, caused by the deadline for the payment of quarterly corporate taxes and the issuing of new Treasury securities. (Full article...)